People rarely use checks as a form of payment anymore. However, there are situations when you need to know how to fill out a check.

If you can’t remember the last time you used a check or have even seen one, you may not remember the correct check format. So, we created a guide you can reference.

Keep reading to learn how to correctly write out a check, record the transaction, and protect yourself from check fraud schemes.

Why Do You Fill Out a Check?

Historical records of check use date back as early as the eleventh century, when an Iranian traveler to Iraq described a system where merchants used a piece of paper, called a ‘sakk,’ to give the bank instructions to make payments from their accounts.

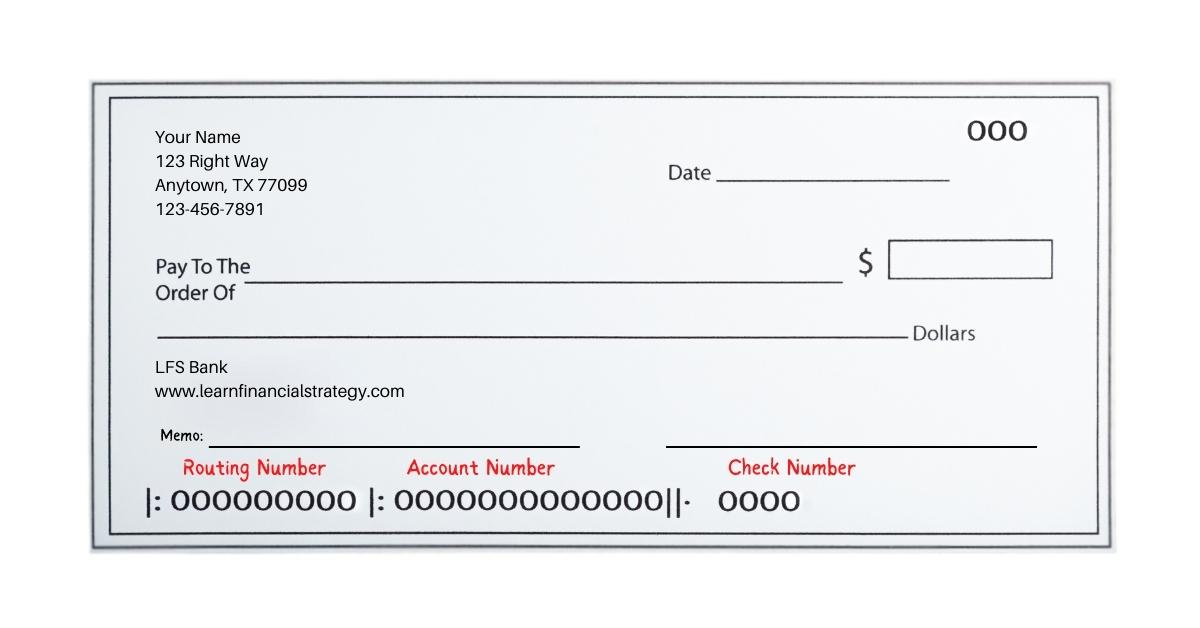

Essentially, checks are the same thing today. It is a piece of paper people use for monetary exchange. The check includes identifying information like your address, bank account and routing number, and a signature for security.

When Do Fill Out a Check?

You should fill out checks before you give them to the payee or mail them. It is not a good idea to fill checks out and carry them around with you because if a thief finds it, they can easily alter the check or steal your information off of the check and use it to steal your identity or access your bank account.

How Do You Get Checks?

In the past, banks gave you checks with nearly every account a customer opened. Now, many banks only provide checkbooks to customers who order them because most people prefer to use a debit card and rarely use checks.

However, if you own a checking account, you can order checks in-person at the bank or on your financial institution’s website. Other third-party companies sell checks.

When ordering checks, you should use a vendor authorized by your bank because scammers could pose as a check printing company to steal your personal information.

Things to Know Before Filling Out a Check

When you use checks, you must use them correctly. Writing checks on a closed or overdraft account is a criminal offense that could land you in jail.

Check Your Balance

Anytime you pay from your checking account, you should confirm that the funds are available to cover the debit. You should also check to ensure you do not have any pending charges that could cause your account to have a negative account balance.

Check Kiting

Unlike debit card payments, checks generally take a few days to clear unless the merchant uses a check processing system that interacts directly with the banking system. Check kiting is a type of check fraud. Criminals take advantage of the check clearing window to make payments for items they know would not clear if the bank debited all charges immediately.

Another form of check kiting is when you write a check and deposit it in another account in an attempt to access funds that aren’t available.

5 Steps to Fill Out a Check

After you verify the funds are available to cover your check, you need to fill out the check. Although the process is very straightforward, you want to ensure you complete the check accurately.

Otherwise, your bank could reject it when the recipient’s bank presents it for payment. Improperly filling out a check may make you more susceptible to identity thieves.

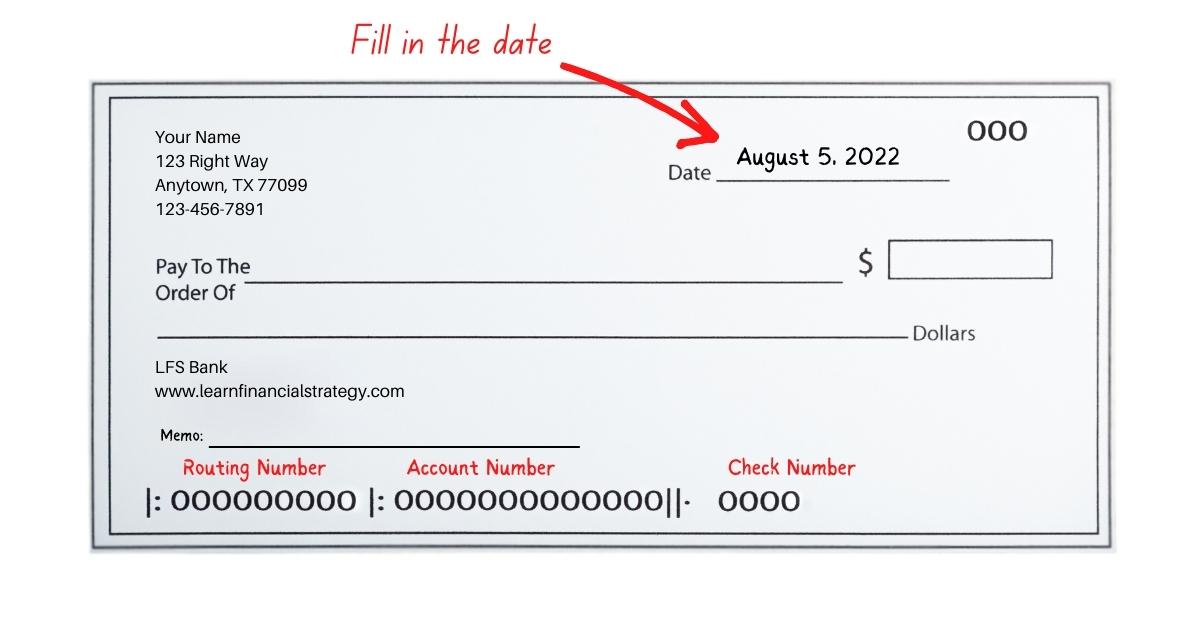

Step 1: Date the Check

Each check contains a date field. Typically, you always date the check for the day you write it. Sometimes, if you want to make a payment on a future date, you can postdate it. While banks do not knowingly allow people to cash a check until the date written on it, it can be deposited beforehand and could cause your other payments to bounce.

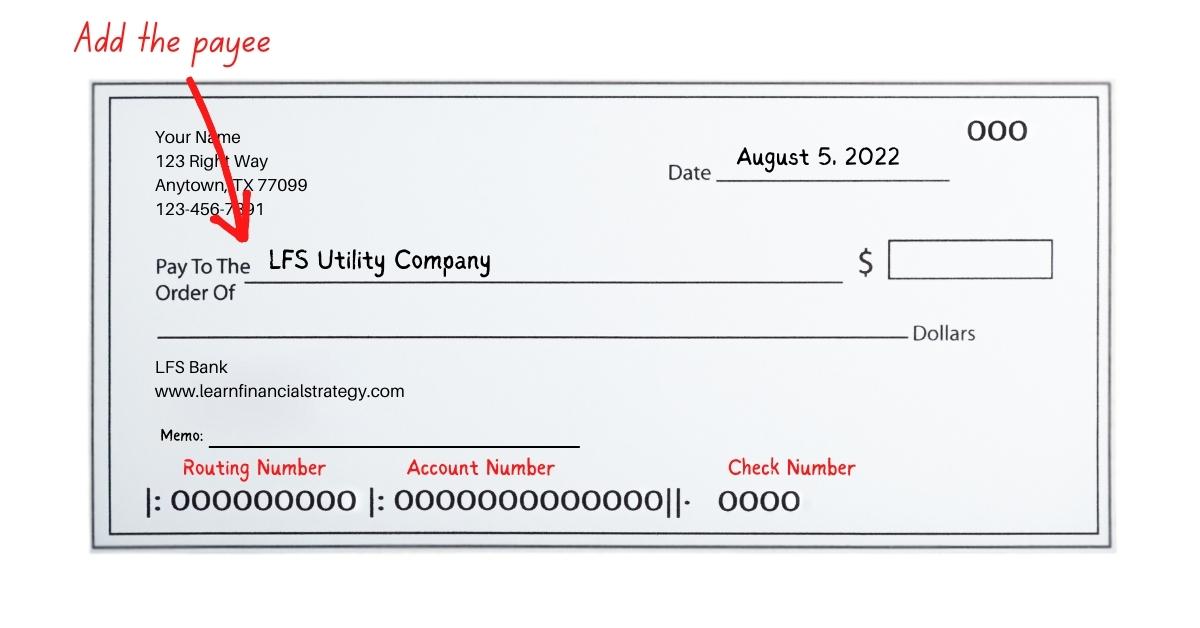

Step 2: Add the Payee

The payee section tells the bank who they should allow to cash the check. This field must match the recipient’s identification because the bank will not cash it otherwise.

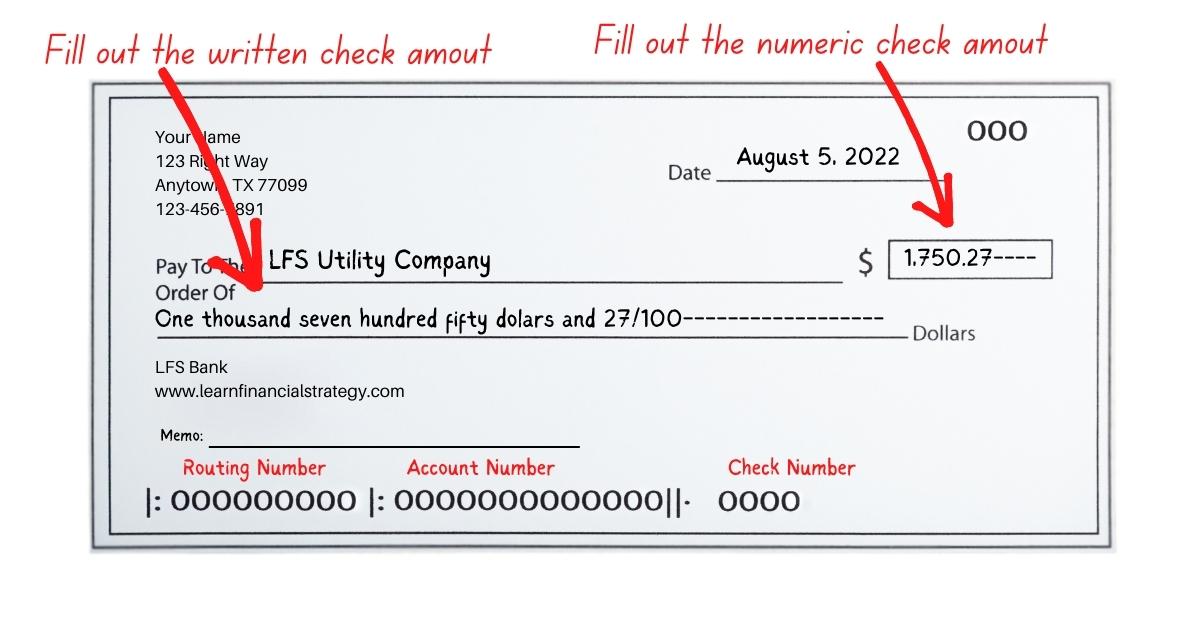

Step 3: Fill Out the Written and Numeric Check Amount

Every check requires you to write the check amount in two different formats. If the amounts do not match, the teller will return the check unpaid. So, filling out both fields is essential. When you add the cents to the written section, you write the amount with a forward slash followed by 100.

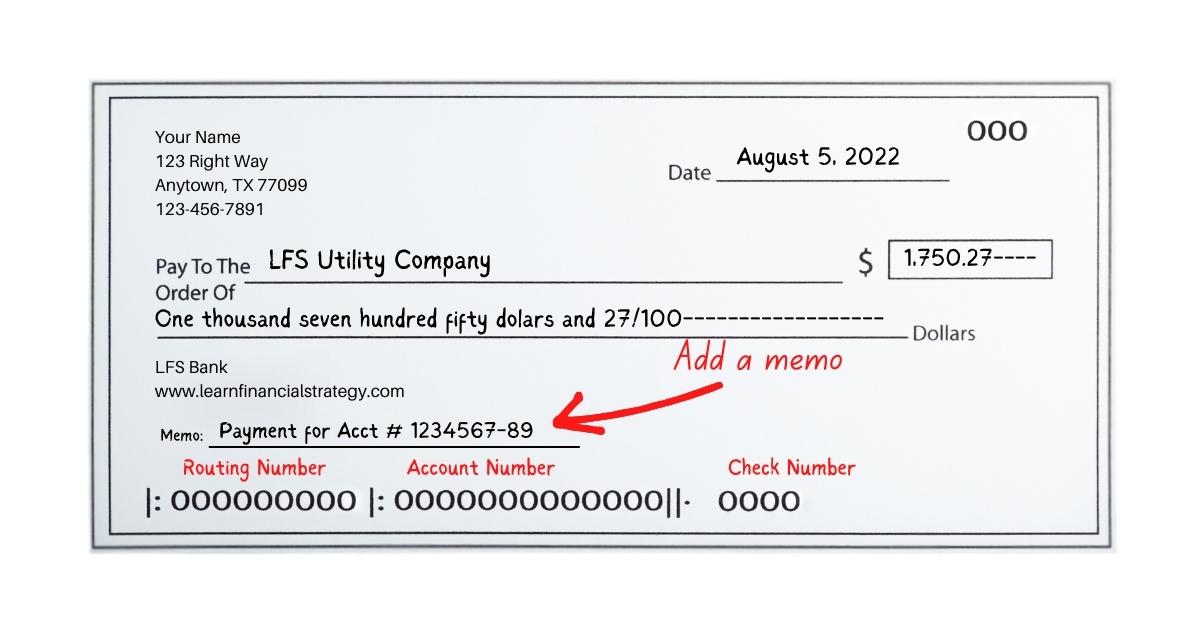

Step 4: Add a Memo (Optional)

Adding a memo is a good idea, especially if you are paying a bill or want to notate what you are paying.

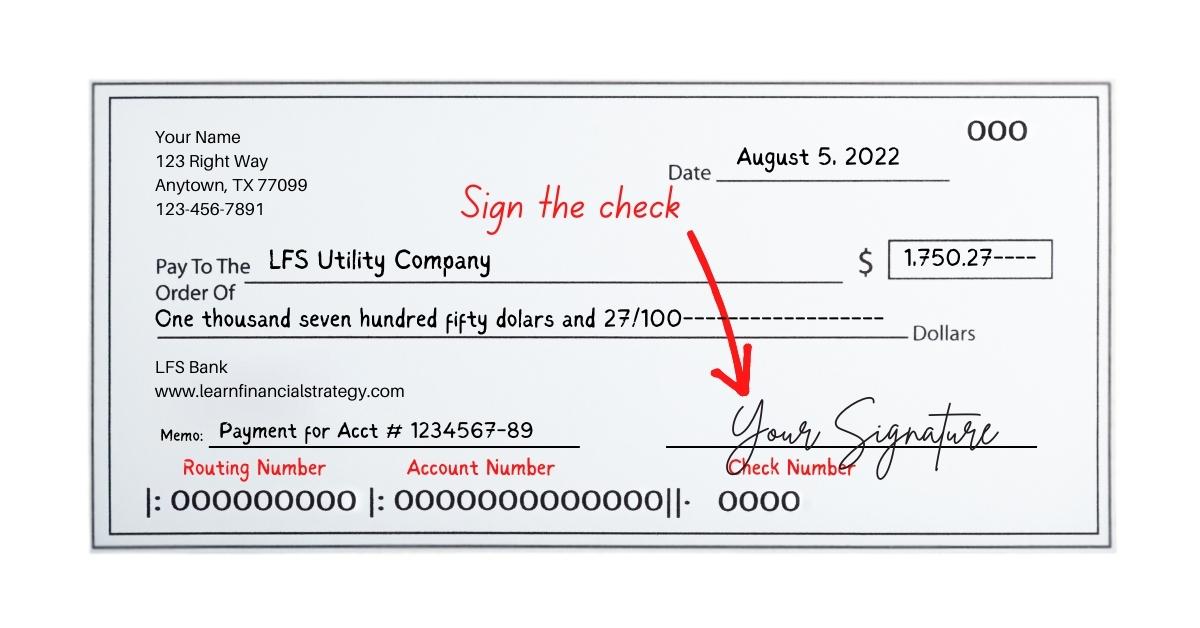

Step 5: Sign the Check

Finally, you need to sign the check. Be sure to add your signature before you submit it as payment. Otherwise, it is not valid.

After: Record the Transaction in Your Check Register

After you write a check, you need to record the transaction. Your bank should include a check register with each box of checks you receive. You should record each debit, credit, and fee in your log. When you write a check, include it in your register with the check number and the date as a debit.

Balance Your Checkbook

When you receive your bank statement at the end of the month, you should go through every transaction to ensure each is in your register. Then, add all of the credits and subtract the debits and fees.

The result should be the balance in your account. If your check register shows a different amount than your account statement, you must review each item to determine what charges or credits are missing.

Retain Carbon Copies

If you decide to use checks with carbon copies, you need to keep them until the checks are clear. After you reconcile your checking account at the end of the month, you can throw away the check copies that cleared that month unless you need them for your taxes.

If you are retaining check copies for items you included on your tax return, you need to keep them for seven years just in case you are audited.

What are Alternatives Available for Writing a Check?

You can use many alternative methods to send payments from your bank account. Several money-sending apps are available for free on GooglePlay and the App Store. Check out these other ways you can pay without a check.

Debit Card

Debit cards have nearly taken the place of checks. Many bank account users have never written a check. However, debit cards work similarly. You use the card to pay, and the merchant uses a payment processing system that sends the electronic transaction to your bank to initiate the payment immediately.

Money-Sending Apps

Several reputable money-sending apps, like CashApp, PayPal, and Venmo, allow you to pay people or businesses without using a check or debit card. You should be aware that there are a lot of scams that utilize these applications. However, if you are careful not to give your information to people you do not know, they provide a quick way to transfer funds.

Zelle

Most major banks give customers access to the money transfer application, Zelle. You can use Zelle to exchange money between your accounts, send payments to other banking customers, and pay some bills.

Security Tips for Filling Out Checks

Checks are an easy target for scammers. They are easily manipulated and give thieves access to your account and routing number, which they can use to make online purchases. Luckily, you can do a few things to help protect yourself.

Never Sign Before You Fill Out a Check

Signing a blank check is never a good idea, even if you give it to someone you know and trust. If someone else finds the check, they can fill in any amount and cash it.

Order Checks With Carbon Copies

Checks are available with carbon copies. These copies help you keep a record. So, if a thief presents an altered check for payment on your account, you have proof of the actual check amount.

Do Not Write Checks Out to Cash

You can write checks out to ‘cash’ if you do not know the payee or want to cash the check yourself. When you write in the payee as ‘cash,’ it tells the teller that they do not have to verify the identity of the party cashing the check. So, anyone can cash the check.

Do Not Carry Your Checkbook

In the past, people carried a checkbook everywhere they went. Today, there is no need to do that. A dishonest person who finds your checkbook can write as many fraudulent checks as they want. If you lose your checkbook and someone uses your checks, you will need to close your bank account and open a new one to prevent the person from using it.

Use Permanent Pen Ink to Fill Out a Check

Using a pen with permanent ink or a pen made for checks is a good idea. Scammers have ways to change the information if you do not use permanent ink.

Draw a Line After the Numeric Check Amount to Prevent Fraud

To stop people from being able to turn a period into a coma and cash a check that is hundreds or thousands more than the amount you wrote, draw a line from the end of the numeric check amount to the end of the box.

Add the Payee and Amount Before Signing

You should fill checks out entirely before signing. Without your signature, the check is not valid. If you sign a check and forget to write in the amount before giving it to the recipient, they can write in any amount. Likewise, if you add the amount but leave the payee blank, anyone who finds the check can cash it.

Use Fewer Checks

The more checks you use, the more likely a criminal will get their hands on one of them. With so many safer options available for paying bills, sending money, and getting cash, you should reserve check writing for transactions that require a written check.

How to Fill Out a Check FAQs

Now that you know how to fill out a check, record the transaction, and balance your checkbook, check out these frequently asked questions about writing out checks.

How Do You Fill Out a Check Amount in Words?

Below are a few examples of how to write check amounts out in words:

- $456.23 = Four hundred fifty-six dollars and 23/100

- $1,111.11 = One thousand one hundred eleven dollars and 11/100

- $987.00 = Nine hundred eighty-seven dollars and 00/100

- $145,145.00 = One hundred forty-five thousand one hundred forty-five dollars and 00/100

- What are the Four Parts You Must Fill Out When Writing a Check?

When you are writing out a check, the date, payee name, written and numeric check amount, and signature are required. The memo is the only field on the check that is optional.

How Should Your Name Appear on Check?

Your name on checks should match your driver’s license exactly. Your name and address are always printed at the top left corner of the check.

Are You Ready to Fill Out a Check?

You might not have to write out a check for months or even years, but when you need to use a check to pay for something, you must make sure you fill it out correctly. As long as you understand the check format, know how to fill the check out, and record the transaction, you should be ready to use checks.

Bookmark this page and use it as a reference the next time you need to use a check, and check out our other guides for investment tips, ways to get out of debt, and other valuable information to help you stay on top of your finances.