The 10/20 rule is a way to handle your finances that helps you to get out of debt. The unique part of this method is that it doesn’t harm your credit like other methods.

This guide explains the rule, how to apply it to different situations, and what you need to make it work. Keep reading to find out how you can use it in your life and free yourself from the burden of being in a constant state of owing more than you can afford.

What Is the 20/10 Rule of Thumb?

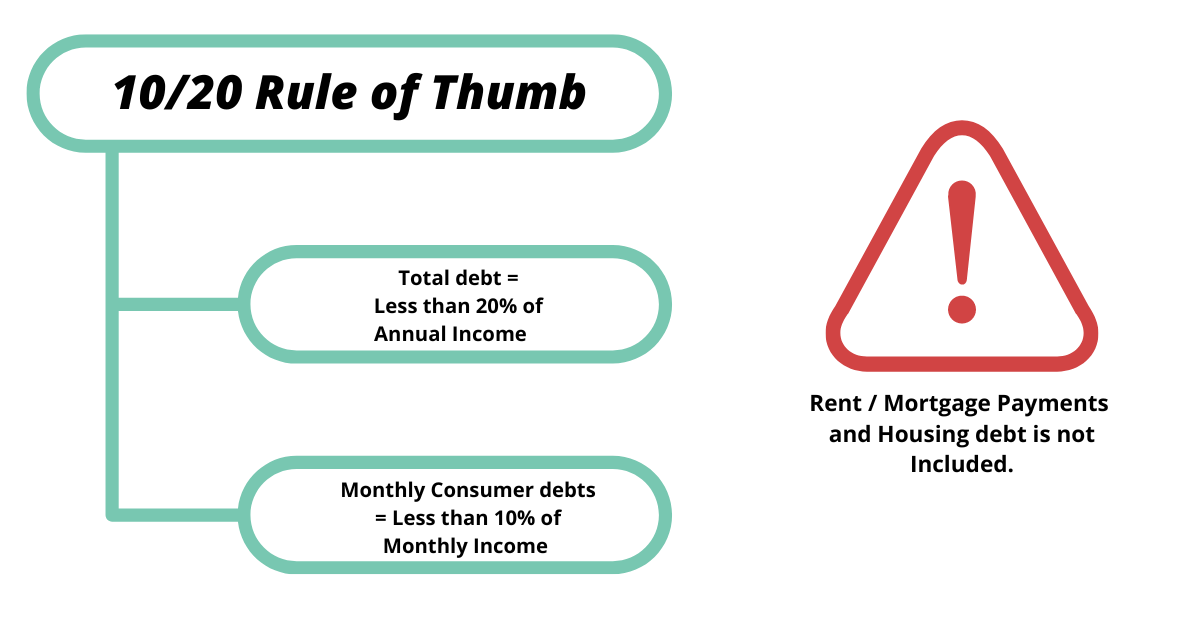

The 20/10 rule of thumb is a financial strategy that helps users allocate their money responsibly. It also helps to improve credit scores because the user keeps their total debt-to-income ratio under 20 percent, which is ideal for credit scoring models.

20 Percent Debt Cap

People following the 10/20 plan take on no more than 20 percent of their annual income. Utilizing this principle, users with more than 20 percent of their yearly income in total debt would need to stop incurring any new debt.

10 Percent Debt Payment Allocation

People applying the rule should not take on more than 10 percent of their monthly income to repay consumer debts. If the total debts a consumer has equal to more than the rule allows, they need to work on paying down some of the debt before committing to any other purchases on credit.

What Does the 20 Percent in the 20/10 Rule Include?

To apply this rule, you must clearly understand each container or bucket. The 20 percent annual debt cap includes all consumer debt but does not include housing.

The debt you need to add to calculate whether you are at, above, or below an acceptable debt level includes:

- Credit cards

- Student loans

- Car payments

- Other installment accounts

What Does the 10 Percent Portion of the 10/20 Rule Include?

The 10 percent portion of the rule includes the same consumer debts but states that the monthly payments for those debts should not add up to more than 10 percent of your monthly income.

What Is the Purpose of the 20/10 Rule?

The purpose of this rule is to limit the amount of debt you currently hold and keep it at an optimal level for credit scoring models.

How to Use the 20/10 Rule of Thumb to Reduce Debt

Many consumers want to reduce their debt but do not know how. They may set goals and have good intentions. However, a goal without a plan is hard to reach. The 20/10 rule is a path that can help you achieve the goal of financial stability easier.

Debt Management

The principle of the 20/10 rule reduces debt by limiting the additional payment obligations you commit to until the debt you have fits within the rule’s guidelines.

Financial Planning

You can use the rule to maintain a financially stable position when you make purchases. To figure out how much debt you can or should incur when making a new purchase, you need to know how much financial obligation you currently have.

20/10 Rule of Thumb vs. 10/20 Rule of Thumb

The 20/10 and 10/20 Rule of Thumb are the same concept. It is just a different way of describing the same principle. Both require you to incur no more than 20 percent of your annual income in total debt and no more than 10 percent of your monthly income towards debt payments.

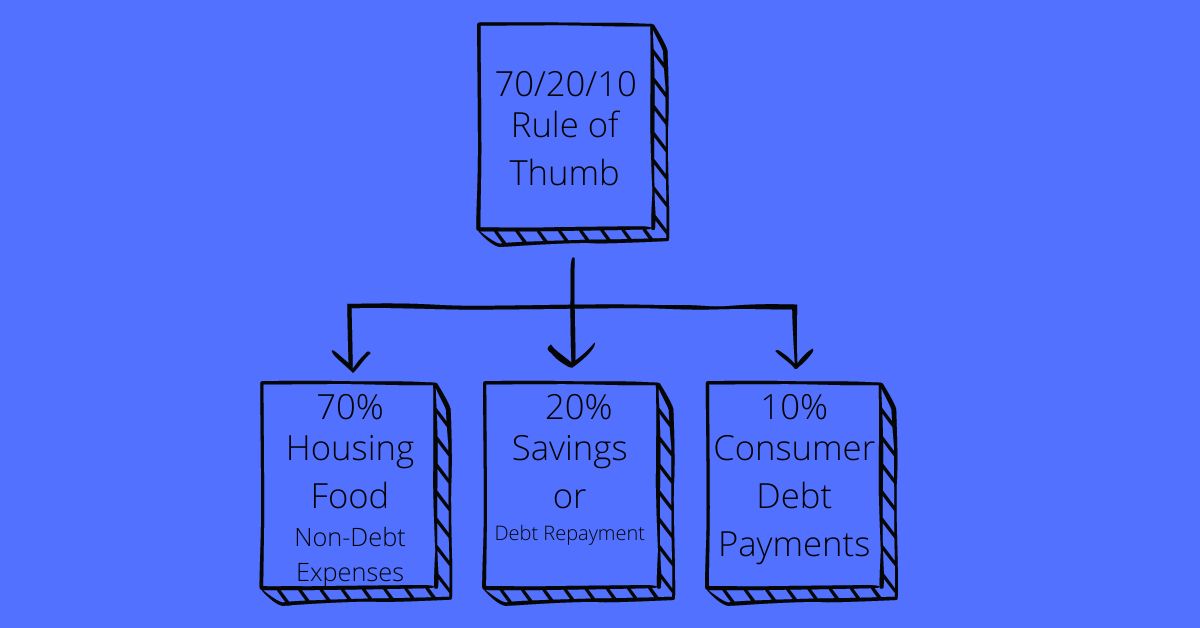

What is the 70/20/10 Rule of Thumb?

If you are trying to get out of debt, the 70/20/10 rule is a great way. With this model, you still keep your monthly credit payments below 10 percent, but you allocate 20 percent of your income to paying your total debt down while using 70 percent of your income for living and other expenses.

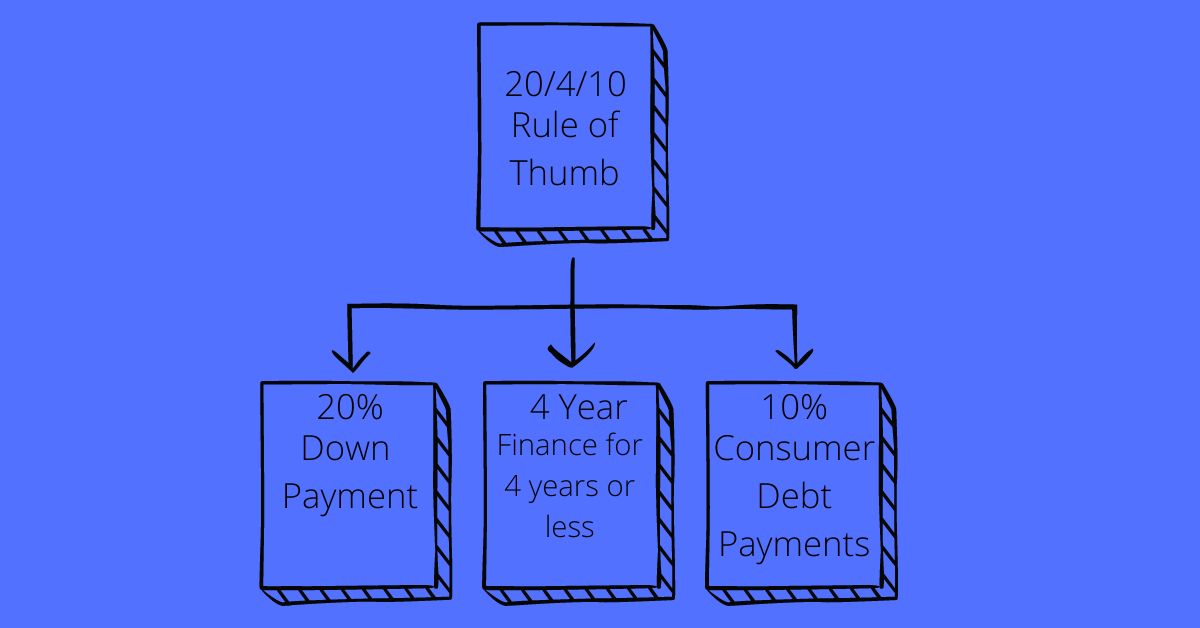

What is the 20/4/10 Rule of Thumb?

The 20/4/10 rule is a formula for buying a vehicle that helps to prevent people from owing more than their car is worth. Vehicles lose value as soon as you buy them. So, the rule states that you should put down at least 20 percent of the vehicle’s purchase price.

It also states that you should not finance a car for more than four years. The longer you finance a vehicle, the more interest you over the life of the loan and the more the car has depreciated by the time you pay the vehicle off.

The final aspect of the rule follows the principle that you should not incur more than 10 percent of your monthly income in debt payments. It does not mean you should sign for a car with a payment that totals 10 percent of your income unless you have no other debts and do not plan on making any additional credit purchases until you pay off the car or your income increases.

20/10 Rule of Thumb vs. 70/20/10 Rule of Thumb

The 20/10 Rule of Thumb and the 70/20/10 Rule of thumb can be used together to pay off your debt quickly. To use these two rules together, apply the 20 percent of the 70/20/10 rule that is typically saved to any outstanding credit obligations. After your total debt equals less than 20 percent of your annual income, you should save the 20 percent portion while keeping debt payments below 10 percent.

How Do You Calculate the Totals for the 10/20 Rule?

You need to know two numbers to apply the rule, 10 percent of your monthly income and 20 percent of your annual income. These numbers are easy to calculate, but you must ensure that you do the math correctly. Otherwise, you may be basing your entire financial strategy on incorrect information.

Calculating 20 Percent of Your Annual Income for the 10/20 Rule

The first figure requires you to multiply your annual income by .20. Suppose you make $50,000 yearly. Following the 10/20 rule, your total debt should be less than $10,000.

Calculating 10 Percent of Your Monthly Salary for the 10/20 Rule

There are a few ways you can calculate 10 percent of your monthly salary. If you know what your salary is each month, multiply that by .10. If you do not know your monthly salary, you first need to divide your annual income by 12. So, if you make $48,000 annually, your monthly income is $4,000.

Then, multiply .10 times $4,000 to get 10 percent of your monthly income, which equals $400. So, your total debt payments should not be more than $400 per month.

How Do You Make the 10/20 Rule Work?

To make the rule work, most consumers need to save and apply a down payment when making larger purchases on credit. For example, if you make $24,000 annually. Your total debt should be less than $4,800. If you want to buy a car that costs $15,000 on credit and you currently have no other debt, you know that you will need to make a down payment of $10,200.

In that case, you have a choice. You have to consider how badly you need a new car. If you are having trouble with your vehicle and need to get to work, you will want to consider whether you should wait it out, buy a less expensive cash car, or go through with the purchase. If you decide to purchase the vehicle, you should limit any other credit usage until you pay the car off.

10/20 Rule of Thumb FAQs

Hopefully, you clearly understand how this rule works and how it can help you get out of debt. If you still have questions, check out the answers to these frequently asked questions.

Why Are Morgage Payments Not Included?

Different models use different figures for calculating how much you should spend on housing, but most people spend around 30 percent of their monthly income on housing. According to experts, spending more than 30 percent on rental payments does not leave enough money for other expenses. So, if you are using the 20/10 rule to budget, you can use 30 percent to calculate how much you can spend on a mortgage.

If I Follow the 20/10 Plan, How Much of My Paycheck Should I Save?

If you follow the 20/10 plan, you should save 20 percent of your monthly income. However, if you are in debt, you should pay the debt with the 20 percent instead. After your total debt is less than 20 percent of your annual income, you can start saving.

The rule requires users to pay debt with the 20 percent before saving because you pay interest on credit payments. So, it is better to pay down your debt than put money in savings because that will save you more money in the long term.

What If My Debt is More Than 10% of My Take Home Pay?

If your debt is more than 10 percent of your take-home pay, you need to limit your credit usage and use the 20 percent allocation to savings to pay down your debt.

What If I Don’t Have 20 Percent to Pay Towards My Debts?

The percentages set forth by the plan are guidelines. It is best to stay within the guidelines. If you are genuinely committed to paying down debt, you may need to make some sacrifices. For example, instead of purchasing a new car, you might want to buy a cash car and drive that while you save for a downpayment on a new vehicle.

Are You Ready to Apply the 10/20 Rule to Your Finances?

The 10/20 rule is one of the easiest ways to free yourself from burdensome debt quickly. It is also one of the most effective ways to manage your credit and ensure your credit score is not impacted by an unfavorable debt-to-income ratio.

If you start using the rule and your debt is higher than 20 percent of your annual income, paying 20 percent of your monthly income towards your debt will help you pay down your debt quickly. Then, keeping your debt below the rule limits will help you keep your debt to a minimum while giving you the ability to save for down payments on larger purchases.

Applying the 10/20 rule does take self-discipline and dedication. It might be challenging at first, but your initial sacrifice will help you conquer debt, save money, and retire earlier.