Have you ever wondered, ‘Can you write a check to yourself?’ It is an excellent question.

So, we created a guide to tell you when you can write a check to yourself, how to write a check to yourself and alternatives. Keep reading to find out everything you need to know to avoid legal trouble.

Can You Get In Trouble for Writing a Check to Yourself?

Writing a check to yourself to close an account or get cash might seem like a good idea. However, sometimes you want to avoid writing a check made out to yourself.

Check Kiting

Check kiting is when someone writes a check to cover charges in another account from a bank account that does not contain enough funds to cover the check. The idea behind this type of fraud is that the person committing it can write a check to cover charges before the bank realizes the funds are not in the originating account.

This fraud usually involves writing a check on an account and depositing it into another account owned by the same individual. It is an illegal practice and punishable by the law.

While check kiting or writing a check from an account without an adequate balance to pay the check is illegal, writing a check to yourself is perfectly legal if the funds are available.

Why Would You Write a Check to Yourself?

There are a few situations when writing a check to yourself might be beneficial. For example, if you want to remove the funds from a bank account, you no longer use or need cash.

What Are the Steps to Write a Check to Yourself?

It is essential to know how to write a check to yourself legally. While it is simple to do if you have experience, fewer people today know how to write a check since most people use bank cards.

Ensure You Have Funds In Your Checking Account

The first thing you need to do is verify the availability of funds in your account. If you recently deposited a check, make sure the funds are available before you write a check on the account. That way, you avoid the appearance of any fraudulent activity.

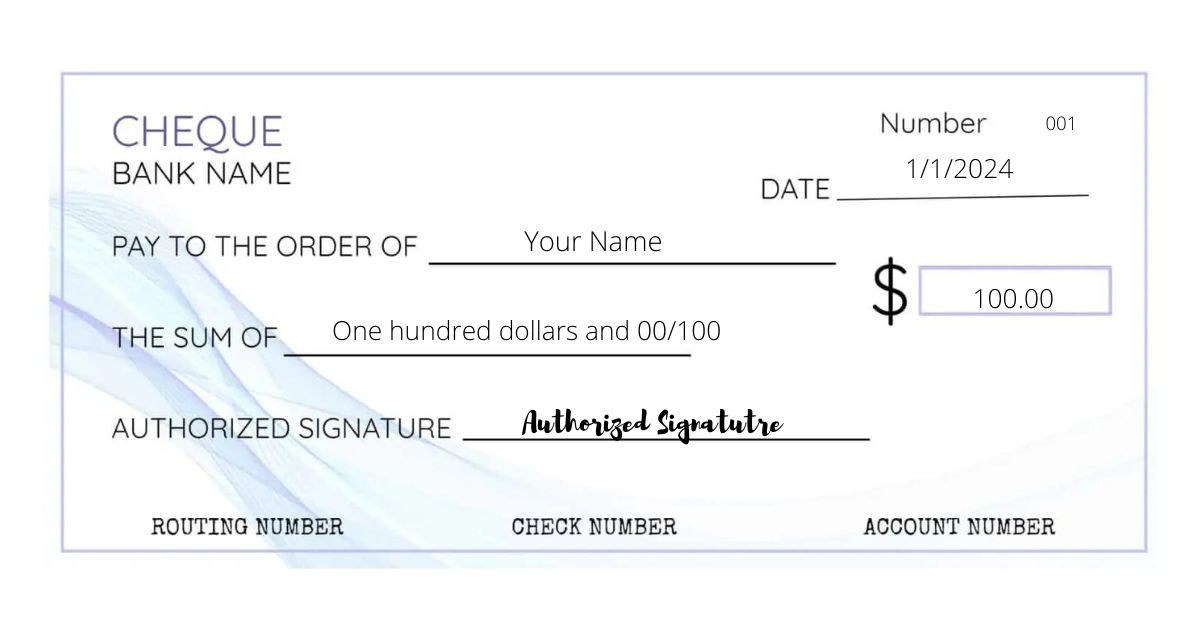

Fill Out Necessary Fields on the Check

There are several fields on the check that you need to fill in, including the date, name, written dollar amount, numeric dollar amount, and signature. There is also a memo section that you can fill in if you like. However, it is not necessary to cash the check.

Deposit the Check

If you plan to deposit the check, you must present it at the bank with a valid government-issued ID. Some banks also require you to submit your bank card when depositing or withdrawing.

Cash the Check

Another option when you write yourself a check is to cash the check. In the past, banks may verify funds and cash the check while you wait. However, most banks now require you to deposit the check and wait until the check clears before they will release any of the funds.

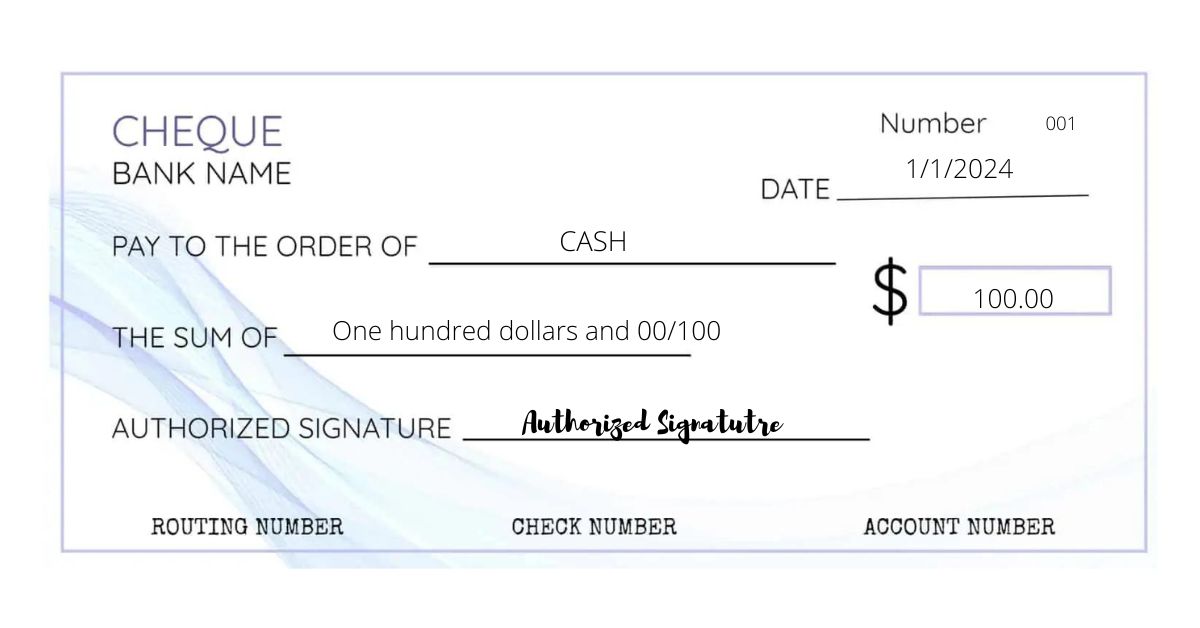

Alternative Way to Write a Check to Yourself

Another way that you can write a check to yourself if you plan on cashing it at your bank is to make it out to ‘cash.’ However, you do not want to do this before you reach the bank because if the check is lost, someone else could cash the check since there is no official recipient.

You can also fill out a withdrawal slip and present it at the bank. Most checkbooks have a section at the front or back with deposit and withdrawal slips. Withdrawal slips have a similar format to a standard check, so filling it out should be straightforward, but if you need assistance, your bank should be more than happy to help.

Easier Ways to Get Cash

There are many alternative ways to receive cash. If your bank is open, you can make a withdrawal. You can also use your debit card to make a withdrawal at ATMs all over the world.

While withdrawing money from an ATM might cost you a fee if the machine is not associated with your bank, withdrawing money from an ATM is quick and convenient.

Move Money Without Having to Write a Check to Yourself

If you are considering writing a check to move money between accounts, there are more straightforward ways that do not carry the same risk as writing a check to yourself.

Wire Transfer

Wire transfers are quick and easy. Simply go to your bank with the account information from the originating and receiving accounts. Tell your bank officer what you need to do and give them the amount you are transferring and the account information. They will initiate the transaction for you.

Zelle

Most major banks give customers access to an application called Zelle that helps them to pay bills quickly, send money, and transfer money between accounts. When using Zelle, you must ensure that you have the correct information for the receiving account. You cannot reverse the transaction if you accidentally send money to the wrong account.

Paypal, CashApp, and Venmo

Numerous money-sending apps function like Zelle. These applications make it easy to pay people on the go, so you do not have to pay in cash. If you need money for a purchase and do not feel like making a trip to the bank, ask if the person you are paying has one of these alternatives. Most people use at least one of these services regularly.

Writing a Check To Close an Account

Writing a check to close an account is an acceptable way to remove money from an account you are no longer using. However, the time it takes for a bank to close an account with no balance officially differs depending on the institution.

Until you officially close the account, a criminal can use your account information to commit crimes, including theft by check. So, it is always a good idea to go to the bank and close the account. If you have funds in the account, the bank will provide you with cash or a check for the balance.

At times, the bank may require a hold of any funds so the bank can make sure that no additional payments have been made on the account before they issue a check for the account balance.

Check Writing FAQs

You should clearly understand when and how to write a check to yourself now. But, here are a few frequently asked questions that may help clarify unique situations.

Can I Write a Large Check to Myself?

When writing a check to yourself, it should not matter what the dollar amount is as long as the funds are available in the account from which you write the check. However, it is essential to note that more significant transactions are often more diligently scrutinized by the bank, and they may put an extended hold on checks written out for a higher amount.

Can I Write a Check to Myself with No Money in My Account?

You should never write a check to yourself or anyone else from an account without the money to cover it. Anytime you write a check to yourself, it may raise a red flag, especially if the funds necessary to cover the payment are unavailable when you present the check.

Do You Understand How to Write a Check to Yourself Legally?

Being financially savvy is more than just understanding intricate tax strategies and investment opportunities. You must also learn how to avoid financial pitfalls that can be costly and illegal.

Writing a check to yourself is not a difficult task. However, you do need to make sure that the funds are available. If you have any questions about how to write out a check or whether or not it is lawful, your bank should be happy to help you.