Wise investors want to know, ‘will my ETF Split?’ And how ETF splits may affect their financial portfolios.

We have the answers to those, and many other questions you may have about ETF splits, ETF Reverse Splits, what ETFs are likely to split, and what to do when an ETF splits. Keep reading to learn all of this and more!

What is an ETF?

An exchange-traded fund, known as an ETF, is a portfolio of stocks that are traded like a stock. Investors use shareholders’ money to invest in a wide range of stocks. If the stocks held by the ETF perform well, the ETF typically performs well too.

What is an ETF Split?

An ETF split is just like a stock split. The shares split at a ratio, so you have more shares, but the value does not go down.

Stock Splits

Stock splits are relatively common; historically, investors do well when stocks split. You do not receive more value when stocks split, but shares usually rise in value following a split.

How Does an ETF Split Work?

When an ETF splits, the company reduces the value of the stock but increases the number of shares an investor owns. So, if you own 50 shares of XYZ Company and the shares split at a 2-for-1 ratio, you will now have one hundred. If the price pre-split were $10 per share, each of your shares post-split would be worth $5.

Why Do ETFs Split?

ETFs split when a rise in share prices makes it challenging for investors to purchase. The idea is to make it available to a wider range of investors.

Liquidity

When share prices become unaffordable for investors, the company’s board of directors may vote in favor of a stock split. Lowering the cost per share and adding two, three, or more times as many shares means more shares are available at a lower price.

Psychology

Splitting stocks does make it easier for some smaller investors to purchase a stock that is trading historically high. After a stock split, many investors see high returns because more people can trade the stock at a lower price.

What is a Reverse Split?

Companies sometimes implement reverse ETF splits. When they do that, they increase the value of each share while decreasing the number of shares each shareholder owns.

Uneven Reverse ETF Splits

At times during a stock split, the shares do not divide evenly. For example, if an ETF is going to do a 6-for-1 split and you own 100 shares, after the split, your 100 shares would only be 14.28 shares.

Each share would be worth seven times what it was worth before the split. The .28 of a share you own would convert back to ‘cash,’ and you would receive a check.

Why Stock and ETF Splits Matter

The truth is ETF splits do not increase the dollar amount of the stock you own. However, when companies are doing well and split, investors typically see a higher rate of return on their investment in the months following the split.

So, while the stock or ETF split does not increase the price, it usually does lead to higher trading in the months following.

Reverse splits may or may not perform well, but when an ETF reverse splits, it is usually a sign that the stock was not performing well, and the company is opting to consolidate shares to make each share more valuable.

Neither an ETF split nor a reverse ETF split affects the actual dollar amount of your investment. However, investors should watch splits carefully.

Additionally, ETFs are a portfolio of stocks that investors can buy shares in, so when the stocks in the portfolio split, it can indicate that the ETF may perform well in the following months or years because the stocks in the ETF are more liquid.

Right now, this is true of the technology industry. So, ETFs heavily invested in stocks like Amazon, Google, Tesla, and Nintendo, which all recently split, will likely perform well.

What ETF Splits Do Analysts Predict in 2022?

ProShares is one of the largest, most successful ETF management companies. Announced several stock splits and reverse stock splits. ProShares often uses splits and reverses to manage the share prices of ETFs it manages to make the funds more appealing to investors.

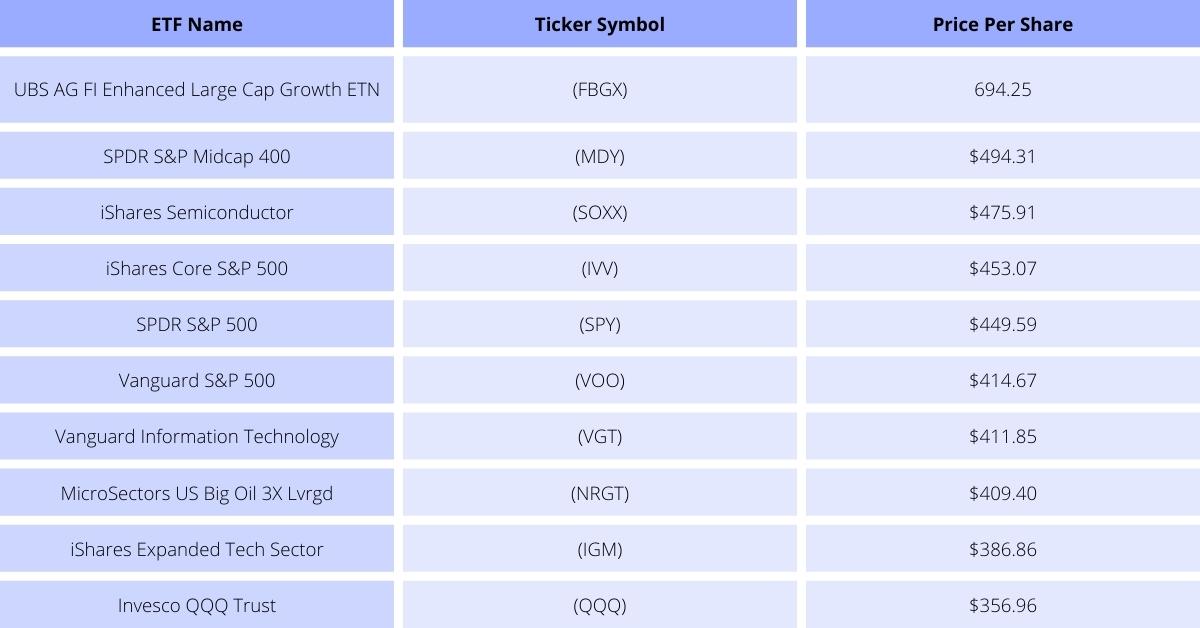

ProShares will likely complete several additional reverses and forward splits in the coming months. Other ETFs that will probably split in 2022, include:

ETF Split Faqs

Now that you know what ETFs are likely to split soon take a look at the answers to the most frequently asked questions about ETF Splits below to learn more.

At What Price Does an ETF Do a Reverse Stock Split?

There is no specific price for an ETF or stock to reverse split. However, to stay, listed stocks must comply with the exchange rules. For the NASDAQ, the stock must not trade below $1 for 30 consecutive days. If it does, the exchange sends them a letter notifying the company. The company would likely do a reverse stock split to raise the price per share.

How Do You Predict When a Leveraged ETF Will Do a Stock Split?

When the price per share gets too high, and the cost per share causes investor interest to decline, the ETF will likely split to make the cost friendly for smaller investors.

Does Vanguard Ever Split ETFs?

Vanguard announced share splits for three of its ETFs in 2021. The Vanguard ETF splits included Vanguard Russell 1000 Value ETF, Vanguard Russell 2000 ETF at 2-for-1, and Vanguard Russell 1000 Growth ETF at 4-for-1.

Do ETFs Ever Fail?

ETFs, like any other stock, can fail. An ETF fails when investors start pulling their money out of the fund. The fund then has less to invest, so the fund may become less diversified. Over time the investment portfolio may dwindle, making it unappealing to investors.

Often by the time an exchange delists an ETF, most investors have already pulled their money out of the ETF and invested in other opportunities.

Do You Know What ETF Splits Mean for You?

If you own ETF shares and the fund splits, your investment value does not immediately change due to the split. However, you may notice higher returns in the months and years following a split because each share price is lower, which appeals to a larger range of investors.

ETF splits are exciting for investors when an ETF is performing well because it means investors who have been waiting for an opportunity to buy shares of the fund are likely to make a purchase. The more people buy a stock, the higher returns the fund will earn.

Many 401k accounts are invested heavily in ETFs. So, remain calm if you notice your 401k is losing money after a stock split. The value may take an initial hit but will likely rise above pre-split levels after the shares stabilize.