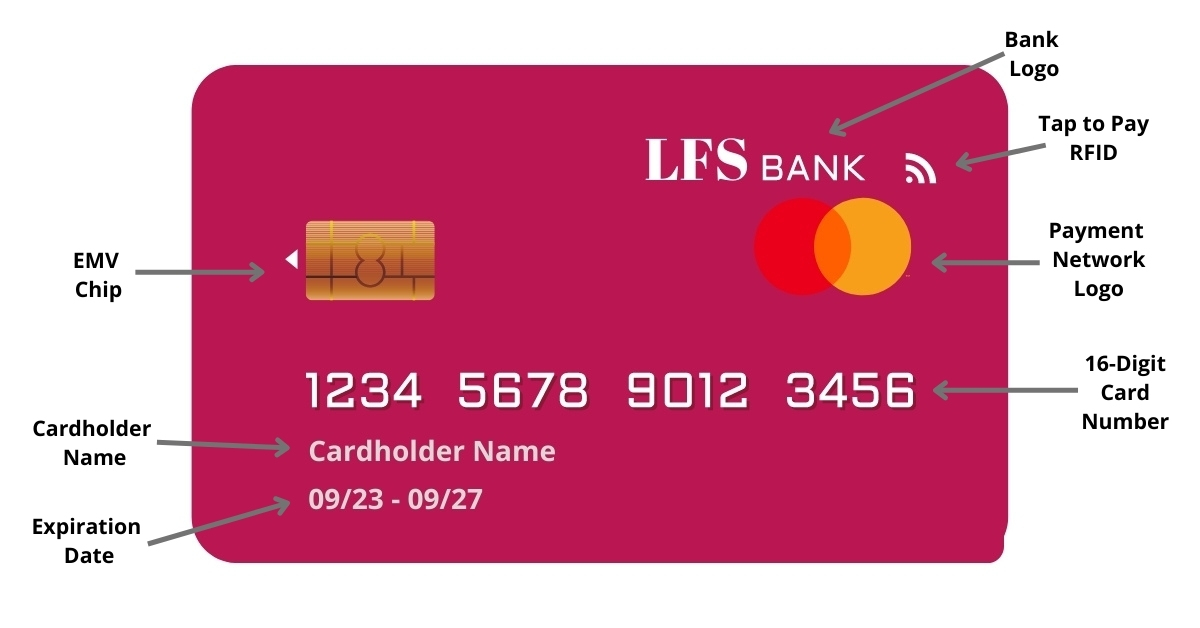

Knowing the parts of a debit card is vital for more than a billion people worldwide. Debit and credit cards are the most used forms of payment globally, and users need to know where to find data like expiration dates and CVV codes to complete payments successfully.

If you are one of the millions who use a debit card in the United States, you need to know each of the features on the front and back. Online merchants and apps often ask for various information. The seller will reject the transaction if you do not know what they are requesting and enter incorrect information.

So, this guide was created to help you learn the different parts of a debit card, front, and back. It also includes valuable information about where to get a debit card, how to use it, and ways of protecting your bank card information from identity thieves.

Front Parts of a Debit Card / Credit Card

Recently, several banks changed their debit card formats. The front is almost entirely blank with just the bank name, Tap-to-Pay capability indicator, EMV chip, and payment network logo.

Bank Logo

Almost every debit card has a bank logo on the front. Many credit cards also include memorable branding. For example, cards with user perks like travel points may include branding like ‘Bank of America TravelRewards.’

The bank logo helps customers identify their cards. For customers with multiple accounts, debit, and credit cards with the same bank, specialized branding makes it easier to verify that they are using the correct payment method.

Card Number

Each debit card has a 16-digit card number. The card number is on the front of the card, grouped in four-digit sections. Grouping the numbers in fours makes remembering and verifying your card number easier.

Cardholder’s Name

The cardholder’s name is present on the front of the card. Merchants may request to see a copy of your driver’s license when you purchase to verify your identity. So, you need to ensure that the name on your cards matches your government-issued identification.

Otherwise, you may run into issues using your card in some places. Additionally, many apps now require users to go through a verification process during which the company compares relevant payment and identification information to ensure that both match.

Smart EMV Chip

In 2021, banks utilizing Europay, Mastercard, and Visa (EMV) payment networks began issuing EMV chip cards. The chip helps prevent identity theft by storing customer card data on a secure chip instead of the magnetic stripe used by previous cards. Only specialized readers can access the data, which helps to reduce the likelihood of a thief stealing your information.

Expiration Date

All cards have an expiration date listed on the card. The expiration date is usually three to four years after the provider issues the card. When the card expires, the user must get a new card. Some cards also include the ‘Valid From’ date, too.

Payment Network Logo

A payment network is a party responsible for overseeing digital payments. There is a payment network whenever you use a debit or credit card. The logo on your card indicating the payment network helps you to determine if a business or vendor accepts your form of payment.

Tap-to-Pay Enabled

One of the newer features banks have begone to include on your bank card is a three-line symbol that signifies that the card has Tap-to-Pay capabilities. The feature allows you to pay for transactions like a digital wallet.

You tap your card on the payment terminal when the cashier finishes ringing up the order. An RFID chip in Tap-to-Pay cards gives them this unique feature.

Back Parts of a Debit Card

Your debit card has more identifying information and security features on the back. Depending on the issuer, some information on the front of a debit card may be on the back. But, there are some features you can always find on the back of your debit card.

Magnetic Stripe

All cards include a magnetic stripe on the back. Even cards enabled with an EMV and RFID chip contain a magnetic strip. Banks have the stripe to ensure that customers can pay when merchants are not utilizing an EMV or RFIC reader or the card chip malfunctions.

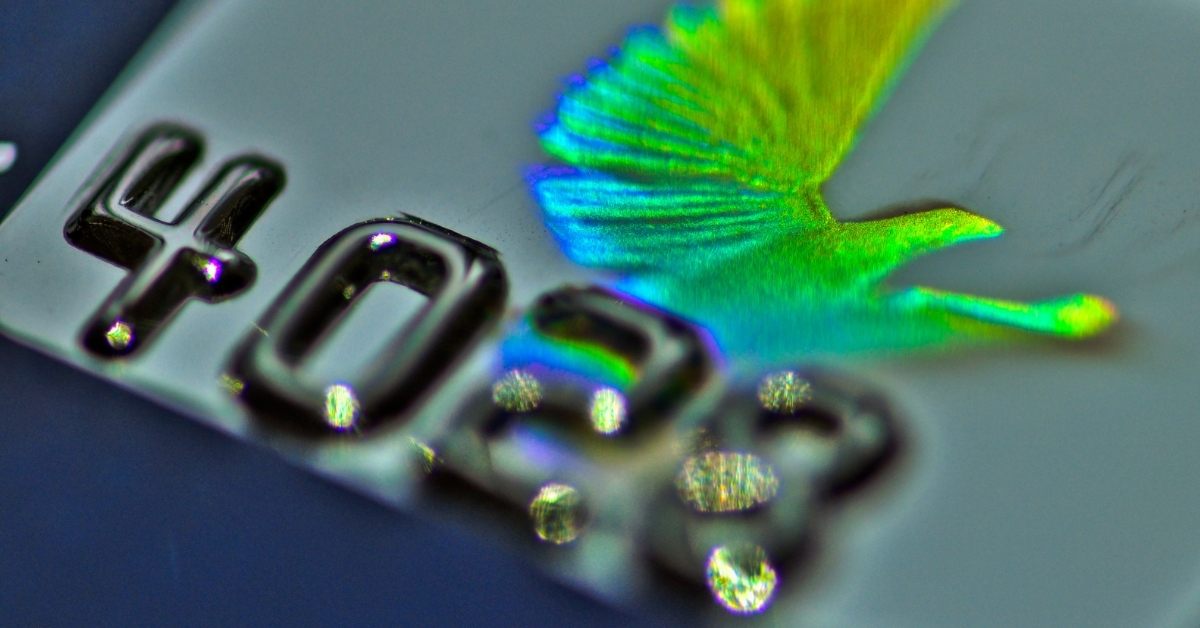

Hologram

Many cards supported by large payment networks include a hologram on the back. For Visa cards, the hologram symbol is a dove. Discover card uses a globe, and the Mastercard symbol is a holograph of its world map logo.

American Express also utilizes these advanced security features. However, AMEX cards may have a hologram on the magnetic stripe, or the centurion symbol on the front may have UV reactive features. Merchants can check the authenticity of a customer’s card by illuminating it with a UV light.

Bank Customer Service Contact Information

All bank, debit, and credit cards list customer service information, including a phone number to help report unauthorized purchases, account questions, and access to account details over the phone.

Authorized Signature Panel

On the back of every card is an ‘Authorized Signature’ panel for the card owner to sign. The signature line is similar to a signature card at the bank. If someone uses your card to make a purchase, the vendor should turn the card over to verify that the signatures match.

Security Codes / CVV

Every card has a card verification value (CVV) or security code that is randomly assigned. Visa, Mastercard, and Discover have a three-digit CVV on the back. You will usually find it on the right side of the card in or around the signature panel.

American Express uses a four-digit code that you can find on the front of the card directly above or below the card number.

What is a Debit Card?

A debit card is a form of electronic payment you can use at restaurants, hotels, gas stations, and stores worldwide. The wallet-sized cards store customer account information on a magnetic stripe, EMV, or RFID chip, or it may use all three.

When you give a merchant your card to pay for a transaction, they will swipe or insert it to collect the payment electronically using a payment terminal. The terminal collects the buyer’s account information and the transaction amount and usually batches all of the charges once daily.

Until the process goes through on both sites, you may show pending charges on your account. However, the payment comes out of your account balance immediately. If a merchant charges a pre-authorization on your card, you will also have a pending charge, but unlike an actual charge, the pre-authorization will drop off your account in a few days.

Where Can You Use a Debit Card?

Debit cards are different from credit cards because they link directly to your bank account. However, you can use your debit card at any merchant location that accepts credit cards by the same payment network.

You can also use your debit card to access funds from ATMs, set up automatic bill payments, and make online and in-store payments.

How Do You Get a Debit Card?

Most checking accounts come with a debit card. So, if you want to start using a convenient debit card to make a purchase, you will need to go to a local bank branch and open a bank account—some national banks like Wells Fargo and Bank of America issue same-day temporary cards.

If you have poor credit or you owe banks money, you may not be able to open a bank account until you pay off your negative banking balance. For individuals who cannot obtain a debit card from a national bank, there are several baking alternatives like PayPal, Chime, CashApp, Credit Sesame, and others that issue money cards.

Why Do You Need to Know the Parts of a Debit Card?

As a consumer, knowing the parts of your debit card, especially where to find the CVV or security code, is necessary when making online purchases and verifying your card information for some apps. If you are a store owner, you need to know where to find card features that confirm the payment’s authenticity.

FAQs About Parts of a Debit Card: Front and Back

You should comprehensively understand the parts of a debit card you need for making purchases and verify that a credit or debit card is valid. Here are a few other valuable answers to people’s most frequently asked questions about debit cards.

Do You Have to Sign the Back of Your Debit Card?

Technically, you are supposed to sign the back of your credit or debit cards. However, debit card transactions do not work the way they did when the cards were first used to make purchases.

Years ago, these cards used a magnetic stripe, and customers signed for each transaction. In those days, businesses always trained cashiers to verify the signatures to ensure that the person using the card was the lawful owner.

Today, you rarely give your card to a store employee. So, they rarely even see the back of your card. When they do, they are not checking for signature verification.

Additionally, many people feel uncomfortable with a merchant relying solely on signatures to verify their identity. So, instead of singing the back, they write ‘See ID,’ which prompts a diligent cashier to ask the user for identification.

While merchants rarely rely on signature comparisons these days, a store owner can refuse to do business with you if you do not sign the back of the card. Although, you will likely never have to worry about that.

How Do I Change the Expiration Date on My Credit or Debit Card?

When your card expires, you need to contact the issuer and request a new updated card. Some merchants automatically send a replacement card when their customer’s cards expire.

What Should I Do If I Lose My Credit or Debit Card?

If you lose your credit or debit card, you should immediately contact the bank that issued the card to report it. The bank will restrict the card and give you a new one. Alternatively, if your bank has a mobile app, you may be able to use the application to lock your card while you look for it.

Locking your card yourself, as long as you do not report it lost at that time, will allow you to restrict usage while you look for the card. If you find it, you can unlock your card and use it. If you contact the bank and have them do it, they immediately cancel and replace the card.

Do You Know How to Identify the Vital Parts of a Debit Card?

Unless you plan to use checks to pay for all of your daily purchases and write checks to yourself to get cash. You need to know how to use a debit card to manage your debt, and knowing where to find the information requested by merchants is critical to completing these transactions.

Debit cards are relatively easy to navigate. The critical pieces of information you need to be mindful of are your card CVV or security code and the expiration date. Remember, if you need assistance finding other information, restricting your card usage, or reviewing your recent transactions, you can contact customer service using the information on the back of your debit card.

As long as you can identify the most critical parts of a debit card and know what they mean, you should have no problem using these electronic payment methods like nearly 500 million people across the United States.